Why invest in themes?

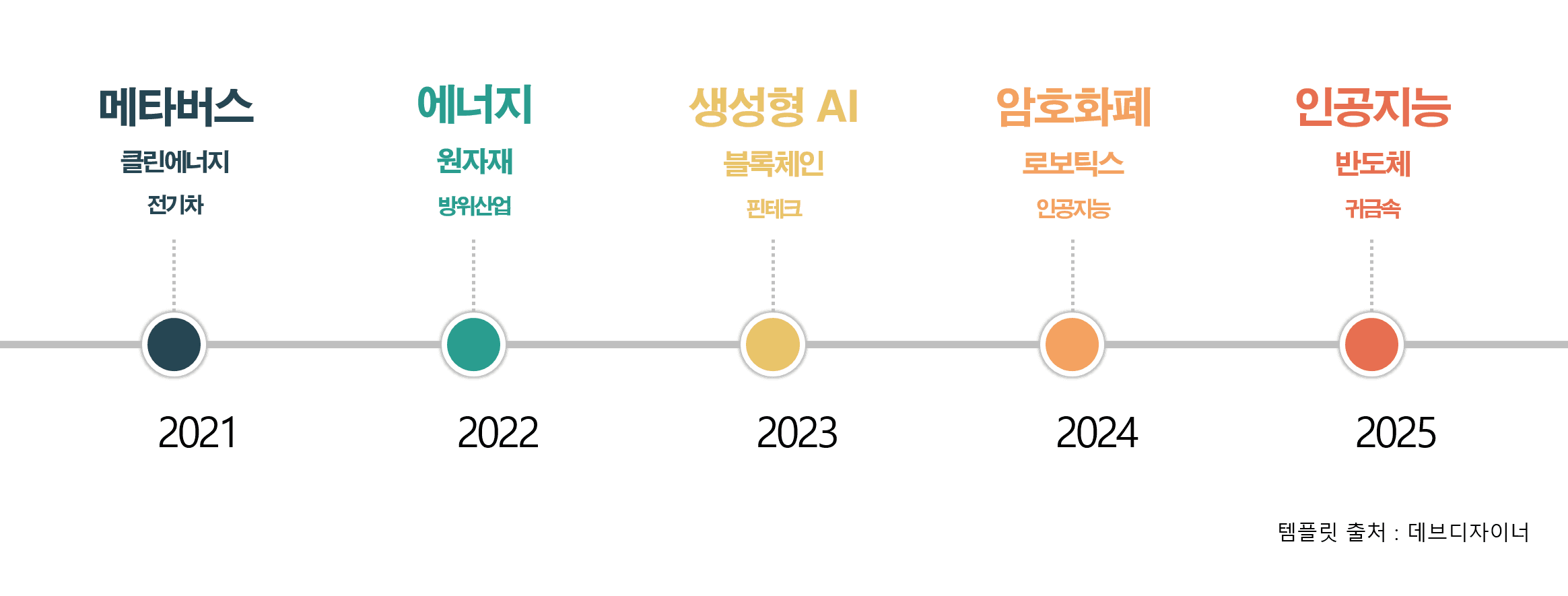

The investment market paradigm has been rapidly changing in recent years. In 2020, the focus was on non-face-to-face interactions due to COVID-19, in 2021, it was the metaverse, and in 2023, generative AI (artificial intelligence) has gained attention. The problem is that it is difficult to predict 'which theme will rise' and even more difficult to determine 'how long it will remain valid'.

If you only invest in individual themes, you can miss the timing or face significant losses if that theme fades. However, there is not enough time or capital to follow all themes.

Multi-theme ETFs were created to solve these concerns.

1. Screening theme candidates using artificial intelligence

In the global market, there are hundreds of themes including healthcare, AI, renewable energy, cybersecurity, and aerospace. It is physically impossible for a person to monitor all of them individually.

Multi-theme ETFs use artificial intelligence to comprehensively analyze global trends, news frequency, search volume, fund inflows, and more. Through this, they select theme candidates that are currently gaining attention in the market or are likely to gain attention in the future. In other words, the role of AI can be seen as a 'primary filter' that finds relevant information within vast amounts of data.

1. Screening candidates for themes using artificial intelligence

In the global market, there are hundreds of themes such as healthcare, AI, renewable energy, cybersecurity, and aerospace. It is physically impossible for a person to monitor all of them one by one.

Multi-theme ETFs use artificial intelligence to comprehensively analyze global trends, news frequency, search volume, fund inflows, and more. Through this, they select candidates for themes that are currently gaining attention in the market or are likely to gain attention in the future. In other words, the role of AI can be seen as a 'primary filter' that finds relevant information within vast amounts of data.

1. Screening theme candidates using artificial intelligence

In the global market, there are hundreds of themes such as healthcare, AI, renewable energy, cybersecurity, and aerospace. It is physically impossible for a person to monitor all of them individually.

A multi-theme ETF uses artificial intelligence to comprehensively analyze global trends, news frequency, search volume, fund inflow, and more. Through this, it selects theme candidates that are currently gaining attention or have a high potential to gain attention in the future. In other words, the role of AI can be seen as a ‘primary filter’ to find relevant information among vast amounts of data.

Final validation and selection by experts

It is not about using the candidates extracted by AI as is. The quantitative managers of Dumulmeori Investment Advisory analyze the fundamentals, valuations, and momentum of each theme to select the final 8 themes.

Diversification considering correlations between themes

Momentum scoring by theme

Considering short-term overheating boundaries and long-term growth potential

Furthermore, for each theme, 2 representative ETFs are selected, resulting in a total of 16 ETFs. In other words, the role of experts is to make 'final analyses and decisions' regarding contexts and risks that AI might overlook.

Expert validation and selection

It does not simply use the candidate groups extracted by AI. The quantitative managers at Dumulmeori Investment Consulting analyze each theme's fundamentals, valuations, momentum, etc., to select the final 8 themes.

Distribution considering inter-theme correlations

Momentum scoring by theme

Considering short-term overheating boundaries and long-term growth potential

Furthermore, for each theme, 2 representative ETFs are selected, resulting in a total of 16 ETFs being included. In other words, the role of the expert is to make the 'final analysis and decision' on context and risks that AI may overlook.

Final verification and selection by experts

This does not mean using the candidates extracted by AI as is. The quantitative managers from Dumulmeori Investment Consulting analyze the fundamentals, valuations, momentum, etc. of each theme to select the final 8 themes.

Diversification considering the correlations between themes

Momentum scoring by theme

Considering short-term overheating and long-term growth potential

Additionally, 2 representative ETFs are selected for each theme, totaling 16 ETFs. In other words, the role of experts is to make the 'final analysis and decision-making' regarding the context and risks that AI may overlook.

Securing stability with non-thematic assets

Thematic investments have high growth potential but also come with significant volatility. To offset this, we incorporate four non-thematic assets such as bonds and commodities into the portfolio, which consists of a total of 20 ETFs. This allows us to pursue both aggressive growth and defensive stability simultaneously.

Securing stability with non-thematic assets

Thematic investments have high growth potential but also significant volatility. To mitigate this, we incorporate four non-thematic assets such as bonds and commodities into our portfolio of a total of 20 ETFs. This allows us to pursue aggressive growth and defensive stability simultaneously.

Securing stability with non-theme assets

Theme investments have high growth potential but also great volatility. To compensate for this, a portfolio is constructed with a total of 20 ETFs by fixed inclusion of four non-theme assets such as bonds and commodities. This allows for the pursuit of both aggressive growth and defensive stability.

※ This graph is a reference based on market data from the past 7 years.

※ Past performance does not guarantee future results, and actual investment outcomes may vary.

Flexibly respond with a monthly rebalancing

Themes change like trends. A theme that was hot 2-3 months ago may quickly wither. Multi-theme ETFs review and replace the themes and ETFs once a month, as necessary.

Weakened momentum themes → liquidation

Newly emerging themes → inclusion

Avoiding concentration on specific themes by maintaining equal weighting

Review and replace ETF holdings within the theme

This allows for proactive response to market changes while avoiding excessive trading.

Flexible response with monthly rebalancing

Themes change like trends. A theme that was hot 2-3 months ago can quickly wither. The multi-theme ETF reviews themes and ETFs once a month and makes changes if necessary.

Weakened momentum themes → Exclude

Newly emerging themes → Include

Prevent concentration in specific themes by maintaining equal weight

Review and replace ETF items within themes

This enables us to actively respond to market changes while also avoiding excessive trading.

Flexibly respond with rebalancing once a month

Themes change like trends. A theme that was hot 2-3 months ago can quickly fade. Multi-theme ETFs review themes and ETFs once a month and replace them if necessary.

Weakening theme → Outgoing

Newly emerging theme → Incoming

Maintain equal weighting to prevent concentration in specific themes

Review and replace ETF stocks within the theme

Through this, we actively respond to market changes while also avoiding excessive trading.

What themes are included?

The theme may change every month, but the recent major themes of inclusion are as follows. The theme is evaluated monthly through AI screening and quantitative analysis, and is flexibly adjusted according to market conditions.

Who are the suitable investors for multi-theme ETFs?

Recommended for these individuals

Those who want to invest in growth themes but are unsure which theme to choose

Those who find it burdensome to go all-in on one or two themes

Those who prefer systematic management through the harmony of AI and our experts

Those who wish to reduce management burden with monthly rebalancing

May not be suitable for these individuals

Those expecting short-term, speculative returns

Those who have strong conviction about a specific theme and want to invest heavily in it

Very conservative investors who cannot tolerate any volatility

Investment precautions

Risk Factors

Theme Volatility: Due to the nature of thematic assets, there can be significant volatility

Exchange Rate Risk: Composed of US-listed ETFs, it is influenced by fluctuations in the dollar/won exchange rate

Past Performance ≠ Future Guarantee: Past performance does not guarantee future returns

Limitations of AI: Thematic screening through AI is not perfect and may be vulnerable to unexpected market events

Recommended Investment Approach

Investment Period: Recommended for a medium to long-term perspective of at least 1 year

Regular Monitoring: Check rebalancing details once a month

In conclusion

The Boolio Multi-Theme ETF is a solution for investors who say, "I want to invest in themes, but I don't know how to do it." By combining the vast primary analytical power of AI with the deep secondary analysis and market insights of our quant experts, we capture changing market trends while controlling excessive risks. We diversify across eight themes, complementing stability with non-theme assets, and respond flexibly with monthly rebalancing.

Theme investing, it’s time to approach it systematically.

Inquiry and consultation

Risk Factors

Please contact our customer service for detailed information about the product.

Please make sure to review the advisory agreement and key disclosure documents before investing.